How Medical Collections Hurt Your Credit Score. Dispute collection accounts online.

How To Remove Medical Collections From Your Credit Report 2021 Badcredit Org

How To Remove Medical Collections From Your Credit Report 2021 Badcredit Org

Disputing medical collections Step 1.

How to dispute medical collections. And if it is paid andor resolved it must be removed from the report. For instance if you have two different medical collections accounts you need to dispute that show up on each of your three credit reports youll need to file a total of six disputes. Address your concerns with the Better Business Bureau 3 days after you send the dispute letters.

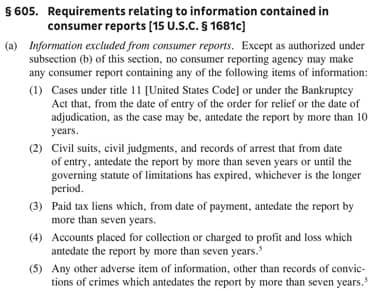

Unpaid medical debt in collections will still remain on your credit report for seven years from the original delinquency date. The following is a guide that will aid you to dispute medical debt. Disputing Collections- Dispute Medical Debt.

Write to the collections agency and demand validation The very first thing you can do when attempting to dispute. Otherwise you might be fielding collections calls. If any item on this list applies to you you can dispute the medical collections record boost your credit score.

When you initiate a dispute the collection agency has 30 days to validate the account. When you dispute the inaccurate collection account you may be asked which detail on the account you believe is. By sending a letter as soon as found an error and if it is sent to collection it should be noted as disputed.

If you want to dispute certain collections it helps to have the proper resources. The best way to delete medical collections is to follow this step-by-step process. If they dont remove it follow up until they do.

In addition to sending a letter you may also want to dispute the collection account by using each CRAs online dispute mechanism. First of all its important to understand how medical collections affect your credit score. An individual dispute will need to be filed with each credit bureau for each item that is mistakenly reported.

Youll pay a subscription fee each month and Lexington Laws attorneys and paralegals will write your dispute letters goodwill letters and medical collection letters for. You can read more here. You should lodge a dispute with each agency that you sent a.

The collection agency will likely report your medical collections account to the three major credit bureaus. First you can dispute with the credit bureaus directly online. Every bureau has its own disputes page.

Tips for Dealing with Medical Bills Any time you are contacted by a collection agency you have the right to written confirmation of the debt as well as the right to dispute it. If a medical collections account on your credit report is incorrect you can dispute the item. They will reach out to the company and typically advocate for consumers.

Back then medical debt hurt your credit score just as much as unpaid credit card. The most convenient and efficient way to dispute inaccurate medical collections on your Experian credit report is online through Experians Dispute Center. Medical bills are quick to go to collections if you ignore them In each instance a 60 day hold was placed on my account as required by law and I was given an address where I.

I was supposed to get. Disputing Medical Bills with the Credit Bureau If the collection agency will do agree to a pay for delete your next step is to dispute the account. It is now 2021 I am just receiving medical bills from 2015 2020I never received any notice regarding these I had a different insurance company in 2015 how do i dispute these chargesit was sent to a collection agency and the office and collection agency have different billing amountsi never received these Bills and have gone to the same physician since 2015.

Break out the magnifying glass and look for errors If step one didnt yield. This could eventually result in you obtaining poor credit. You can dispute the account by mail phone or online with TransUnion Experian and Equifax.

You should both fax the letter and send it by mail. Write and send a goodwill letter asking for relief explain your situation Call and attempt to negotiate a deletion in return for payment Pay for Delete Mail the collector asking for proof of your debt. Teaming up wa credit repair pro like Credit Glory makes the dispute process super easy.

You can also call your insurance company to ask if theyve paid the bill. If a medical collection item is more than seven years old write a letter to each of the credit bureaus asking them to remove the item due to the age of the item. There are three main methods of filing a dispute.

Last year new rules made it so that medical debt cannot be posted to a credit report until its at least 180 days past due. You can file this dispute on your own. So if youre disputing your medical bill dont let your medical provider hold your credit report over your head.

You want to go online and file a complaint about your Medical Debt Collector on the BBB Website. After the medical bill has been disputed and the error of the billing department has been acknowledged you will be given a new medical billing with adjustments. Before 2014 FICO the most common credit-scoring system treated unpaid medical collections the same as any other debt.